PLAN FOR PROSPERITY & FAMILY PROTECTION

Build life-long retirement income

Save for children's education

Preserve existing retirement savings, such as 401K/403B plans

Schedule A Free Consultation And Get A Bonus $300 Hotel Savings Card

WE FOCUS ON HELPING INDIVIDUAL AND THEIR FAMILIES TO ACHIEVE A FINANCIAL STRENGTH AND JOYFUL RETIREMENT

Working with you to understand your life goals and develop a personalized wealth strategy. Today and for the years to come.

401(k) 403 (b) Rollovers

IRA, Roth IRA, SEP Plans

Retirement Income Strategies

College Savings

Annuities

IUL as a saving tool

Our service protects your saving from market risk. Your savings, placed into a safe saving tool, still will grow, not as fast as in stock market but without the risk of loss.

Schedule A Free Consultation And Get A Bonus $300 Hotel Savings Card

Let Us Help You Prepare For All That's Ahead

HERE’S HOW IT WORKS

Have A Free Consultation

Answer some easy questions and we’ll do all of the calculations and suggest the best strategies to build a plan for you.

Review your plan

You’ll see exactly what to do on a monthly basis to maintain your lifestyle now and in the future.

Make it happen

Make your decision, and we’ll put your plan into action fast.

About Us

My name is Natalia Doudko, I am a Representatives of Amerilife, which has been in business for more than 50 years, educating people about financial strategies for prosperity and family protection. We specialize in retirement planning for small businesses and self-employed, as well as employees of larger corporations, helping people to achieve financial strength and joyful life.

We can meet at our office at 8081 Philips Hwy, Suite 10, Jacksonville, FL 32256. If you live far away from Jacksonville, we can meet virtually on Zoom or phone.

Still have a few questions?

Here are the answers to some questions we’re frequently asked by people.

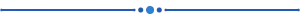

When should I start to save for my retirement?

The sooner, the better. If you start in your twenties, you will have about 40 years to save. It means your monthly retirement payments will not be high, the same time compound interest will provide effective growth of your funds. We look at your unique situation and make suggestions, which are in your best interest. You are a decision maker.

I am 50 years old. I have a 401K plan with my previous employer. New statement indicates losses. What should I do?

You should roll over your retirement savings from your previous employer 401K to safe tools, which guarantee your principle. Our best recommendation would be to start an IRA, and use fixed index annuity as an investment tool. This way you avoid losses associated with market risk.

Is my retirement income taxable?

If you have 401K/403B retirement plan or Traditional IRA, then yes, your savings are taxable at time, you will access your funds as a retirement income.

If you use a Roth IRA, you already paid your taxes before placing money in the Roth IRA, and your retirement income will not be taxable. When you max out your 401K/IRA, there is an alternative saving tool to Roth IRA, which can build non taxable retirement income. It is IUL. Ask us if it works for you.

What is SEP IRA?

SEP IRAs are available for small businesses with one employee or more. It is an efficient retirement saving tool for the self employed. They have much higher contribution limits than Traditional and Roth IRAs ($61,000 for year 2022). So if you’re contributing at the max, that’s way more than your typical IRA. Additionally, contribution amounts aren’t set in stone— you can change them as needed, from year-to-year. It is pre-tax money.

What is the most safe and effective way to save for retirement?

Fixed Index Annuities provide protection of the principle and growth of your retirement savings, unlike mutual funds exposed to market volatility and risk of losses. Please do not confuse them with variable annuities, which are associated with stock market and its risk

Our Travel Partner Redeem Vacations Has Joined Us To Provide You With $300 Hotel Saving Card

Schedule and attend your Free Consultation and you will get electronically your $300 Hotel Saving Card

The Hotel Savings Card will provide you with cash credits to be applied to your next getaway

Schedule A Free Consulation And Get A Bonus #300 Hotel Savings Card

What Is The Hotel Savings Card Exactly?